As a responsible insurer our aim is to be clear and transparent on where your premiums go. Another important step in being here for the long haul is prudent financial management of our Mutual. With this, we aim to be profit making, rather than profit maximising.

The information and graphic contained within this article were accurate at time it was published but are now out of date.

We need to run the business commercially and our profit is added to capital reserves to support the stability and growth of the business, and to meet the solvency requirements as set by the Reserve Bank of New Zealand. Also, it’s used to invest back into rural communities.

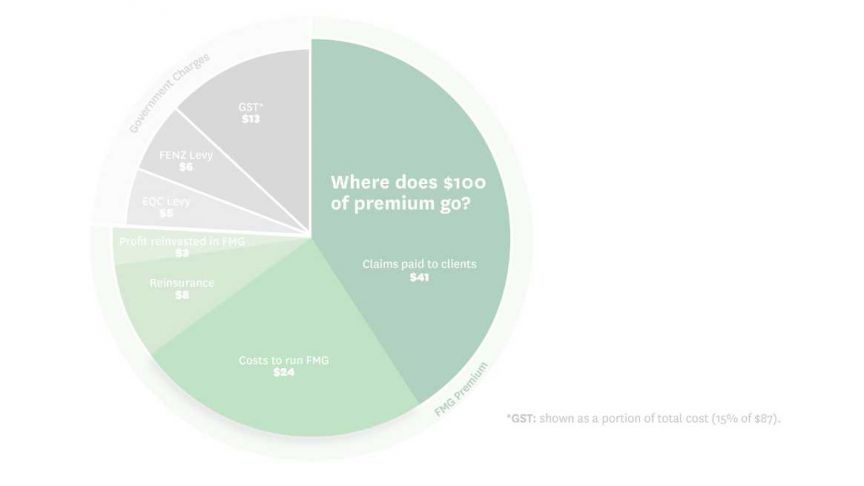

The infographic on this page shows the breakdown of where your premiums go, this being in support of our goal to provide access to affordable insurance.

With this, we take several things into consideration when calculating premium. These include the covers you personally have insured with us, your location, levies we’re required to collect on behalf of EQC and Fire and Emergency New Zealand and costs to run the Mutual, including for things like reinsurance and claims.

When calculating this year’s premium, there are two areas in particular to highlight.

Claims costs

Like so many others across the country right now we too are facing increased costs and challenges.

Building materials and equipment costs are having an impact across the board putting pressure on the costs of rebuilding and replacing, which means the average claims cost is increasing.

Our premiums are calculated by using our understanding of claims costs, the cost of running the business and reinsurance costs. All three of these are also under pressure from the likes of natural disasters, weather events and rising running costs such as fuel.

EQC levies

Another thing to be aware of is the EQC cap changes later this year. What’s changing is that EQC is moving from covering the first $150,000 of an earthquake, landslip, volcanic, tsunami or hydrothermal related claim to the first $300,000 for new business and renewals from 1 October 2022.

This means that EQC levies will be increasing to cover the higher cap. The EQC levy is charged at the same rate nationwide, whereas FMG, and other insurers, charge premiums that vary based on a number of risk factors. Therefore, the impact on your overall premium will vary throughout the country. It’s also important to note that a number of other factors will also impact your premium, such as increased rebuild and reinsurance costs.

There is no change to the way you lodge an EQC claim. You still contact us as your private insurer, and we’ll work with EQC on your behalf.

Value of insurance

We strive to keep premium increases to a minimum for the cover offered so our insurance remains affordable for rural and regional New Zealand. These unique mutual features distinguish FMG from most other insurance companies in New Zealand.

With cost increases it is important that you review the value of what you are insured for. Making sure you have the right sum insured, based on an up-to-date valuation, is important so that if the worst does happen, you are sufficiently covered.

You can check these on FMG Connect and if any values need updating get in touch with us for a revised quote.

You can request a review of your existing cover online. Increasing your sum insured may have an impact on your premium, however you may find it’s not as much as you think