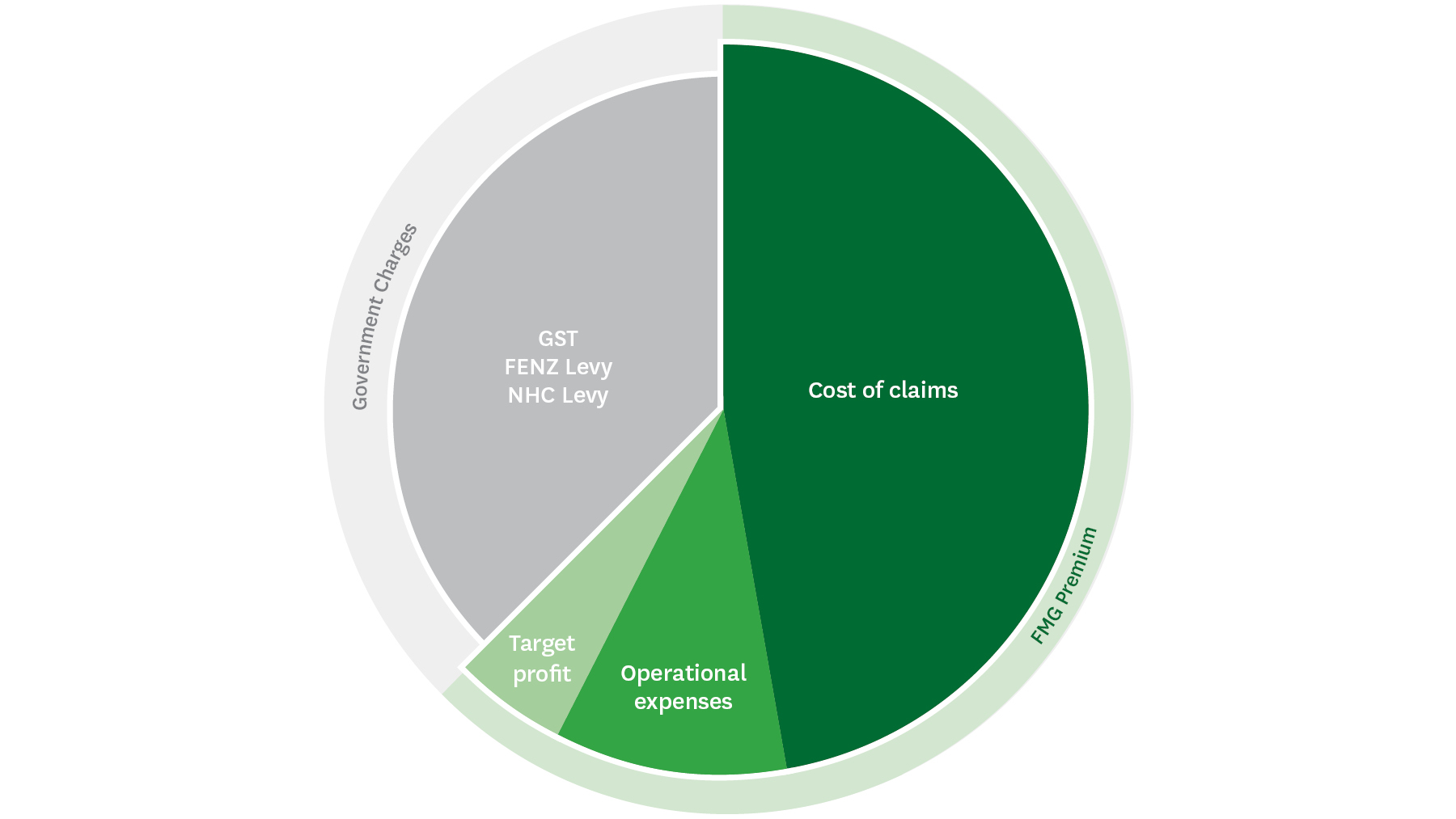

What makes up my premium?

This breakdown is reflective of FMGs average House premium as at 30 April 2025. Clients’ premium breakdowns will vary depending on many factors, for example construction materials and location. Individual premium breakdown can be found on a Client’s FMG quote and/or statement.

Your insurance premium is the payment you make to insure your assets, such as your home and contents, vehicles, or farm machinery. It consists of several components:

FMG's premium share

The amount of premium you pay to FMG is determined by the specifics of what you’ve insured. It covers paying claims, the costs of running FMG, and the cost of purchasing reinsurance. Reinsurance serves as FMG's own insurance, designed to cover significant claim events. It is a safety net, ensuring our capability to handle large-scale claims that might occur during major events, such as Cyclone Gabrielle.

As a mutual FMG's members are its owners so any profits generated are reinvested into the business, ensuring we can be here for another 120 years. You can find more about what it means to be part of a mutual here.

Government’s premium share

This share depends on what type of insurance you have and can consist of three main elements:

Fire and Emergency (FENZ) Levy: A mandatory levy for certain policies covering fire risks. It funds Fire and Emergency New Zealand’s services, including response to fires, vehicle incidents, floods, hazardous substance spills, medical emergencies, and animal rescues.

Natural Hazards Insurance Levy: The Natural Hazards Commission Toka Tū Ake provides cover up to a certain amount for damage to residential homes in the event of a natural hazard. As your insurer we collect this levy through your premium.

Goods and Services Tax (GST): GST is applied to most goods and services in New Zealand, including insurance.

Why do my premiums change?

We regularly review the cost of providing insurance, which can result in changes to the premiums we charge you. Of the premiums we collect, the largest portion goes towards paying claims. We monitor trends in the number and cost of claims to set our premiums. The increasing amount and sophistication of technology within what we insure, along with factors such as rising labour, material, and equipment costs result in more costly claims on average.

New Zealand is exposed to, and has unfortunately recently experienced, severe weather and natural hazard (natural disasters) events like storms and earthquakes. These events, along with other global events, have raised reinsurance costs, which ultimately factors into the premiums you pay. As more data on natural hazards and perils like earthquakes and floods becomes available, the insurance industry in New Zealand is moving towards reflecting more of that risk in individual premiums (risk-based pricing).

For example, between mid-2024 and mid-2025 we made premium reductions of around $35 million across several products, linked to improving claims trends, meaning clients holding these products may benefit through premium decreases or smaller premium increases on renewal.