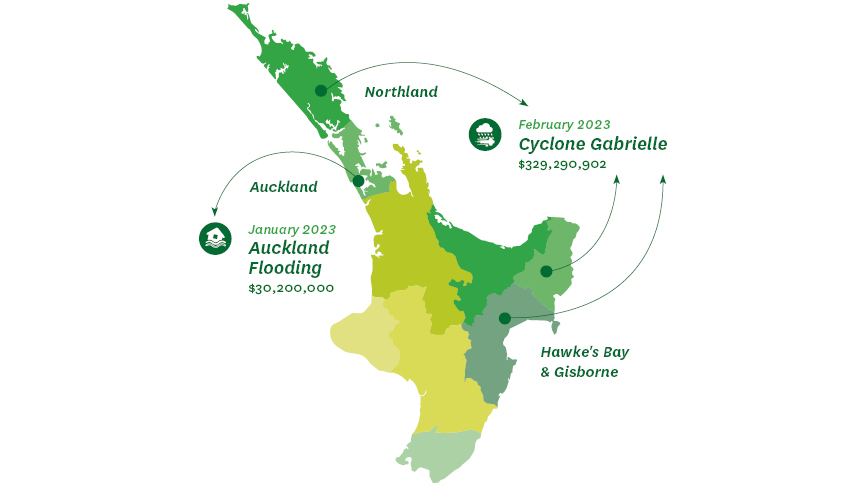

Our thoughts are with everyone impacted by Cyclone Gabrielle and the Auckland Anniversary Weekend flood events. So far we’ve lodged more than 11,900 claims, paid $281.9m in claims, and closed more than 95% of claims received.

Monitoring and updating your claim

Please know that if we have received your claim, we are working on it. As our phone lines are understandably busy you'll find it much faster to monitor your claim's progress in FMG Connect, anytime, anywhere. You can also upload any supporting documents such as photos and receipts. If you do need to call us – we're here on 0800 366 466.

Our people in your time of need

Last year we interviewed 38 of our people to hear their stories of Cyclone Gabrielle and the Auckland Anniversary Weekend flood events.

As an insurer it is our purpose is to get people back on their feet when the worst things happen. Here are our people, talking about that purpose.

Severe weather events

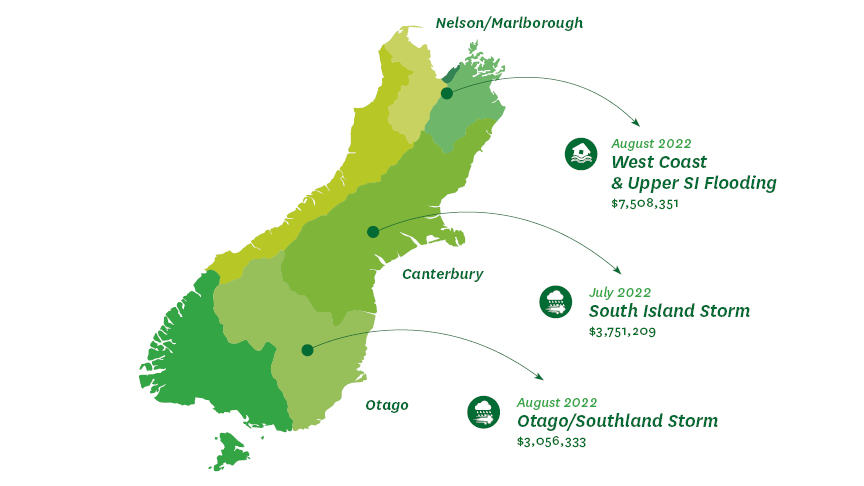

FMG is seeing an increase in the incidence of severe weather-related events impacting our clients. Check out the cost of severe weather events for FMG in recent years.

Dealing with silt and debris on your property?

- Assume its contaminated with sewage or chemicals – check with your local Council that it is safe to remove it.

- Check with your local Council about any co-ordinated removal or dumping arrangements.

- Keep any receipts for removal or disposal to support any insurance claim you are able to make.

Helpful information

- Cyclone Gabrielle Response (Hawke's Bay Regional Council)

- Advice and clean-up grant information (MPI)

- Dealing with stress and uncertainty (Farmstrong)

Wellbeing

Rural Support Trust

Sometimes you can do with a chat with someone who gets your issues because they've been there before. Rural Support Trust have local, rural people who know from experience what challenges farmers and growers face - especially during the current weather event challenge.

Call 0800 787 254 for a confidential chat about you, your business, the weather, your finances, or a neighbour, partner, friend, family member, or worker.

Insurance cover

Livestock Cover

If you have Livestock cover, both specified and unspecified livestock are covered for accidental death directly caused from flood.

Business Interruption Cover

For our impacted clients with Business Interruption insurance there is cover for financial loss as a result of damage to buildings, contents or stock. There may also be cover for loss of utilities, prevention of access issues or public authority action.

Each person’s circumstances are different, so If your farming or business operation is currently affected due to major storms or flooding, please give us a call to discuss what cover you have in place.

Farm Fencing Cover

If you have taken out cover for your farm fencing, you are covered for flood damage up to $20,000 (or the sum insured, whichever is lower).

Temporary Accommodation Support

If your home cannot be lived in because of storm or flood damage and you need financial support with your temporary accommodation, please call us on 0800 366 466 to see if we can help.

This support falls under your FMG Household Contents insurance. Additionally, if you have tenanted and employee houses with us, there may be support options available for you with these too. Each person’s circumstances are different so please give us a call so we can discuss what’s best for you.