What to expect when your policy is coming up for renewal

Before your policy with us renews we'll usually send you an email about your account and provide you with any support and information we think you might find helpful. Keep an eye on your inbox for this handy email (you can update your email address with us in FMG Connect or contact us).

We'll send you your renewal statement 3 to 4 weeks before your policy renews (email or post, and you can view it in FMG Connect).

Review your renewal details

You will receive the following which you should read and take note of any changes:

- Renewal Statement letter

- Invoice/statement (detailing premium, amount to pay or list of instalments/charges coming up)

- Transaction summary and policy premium summary

- Policy Certificate (outlining your covered items, including key details such as Sums Insured and Policy Excesses)

- Important Conditions and Explanatory Notes

- Disclosure statement

You'll get a renewal statement per policy each year. If you make a policy change, such as adding an item or removing an item, you'll get a new statement.

Changes? For most items you can make changes (e.g. sum insured amounts), and review excesses and coverages in FMG Connect or contact us.

No changes or questions? Great! Simply review the amount to pay and due date on the invoice. Learn more about Ways to Pay.

Paying by direct debit or agency? To review your direct debit, or change your bank account number or monthly payment date, log in to FMG Connect or contact us).

Understanding premiums

Your insurance premium is the payment you make to insure your items, such as your home and contents, vehicles, or farm machinery. Learn more about how premiums are made up.

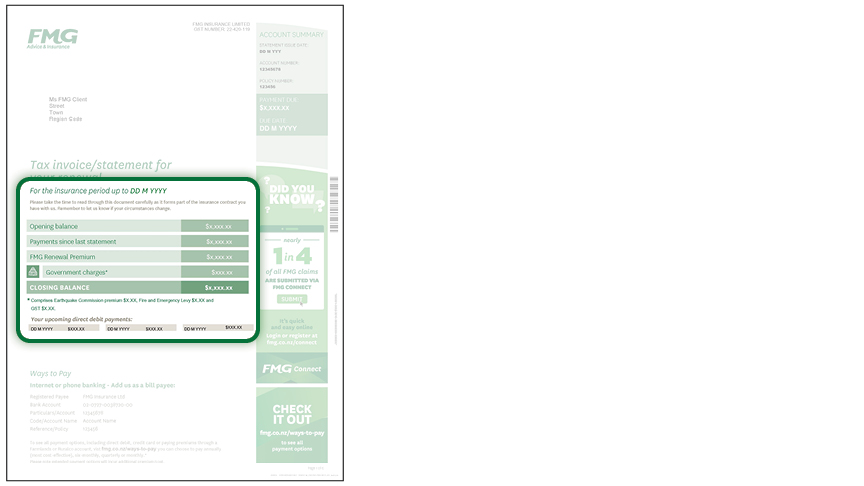

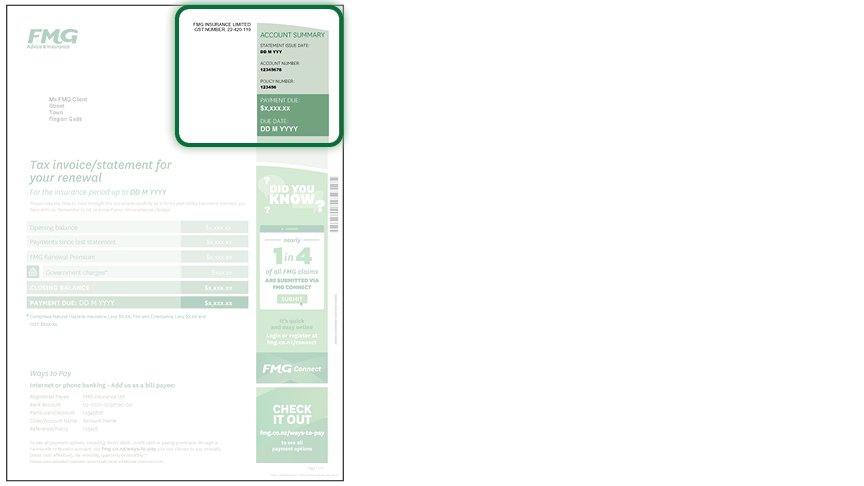

Tax invoice / statement | Where to see key information

- Insurance period for your renewal

- Opening balance (from your last statement sent to you)

- Payments since your last statement

FMG Renewal premium - Government Charges (comprises Natural Hazards Insurance Levy, Fire and Emergency Levy and GST)

- Closing Balance (amount remaining to be paid)

- List of all upcoming payment/charges

- FMG GST Number

- Statement issue date

- Account Number

- Policy Number

- Payment Method

- Payment Frequency

- Next Payment Date and Due Date

Important Conditions and Explanatory Notes

It is important that you review these details carefully, paying attention to the Important Conditions and Explanatory Notes contained on page two.

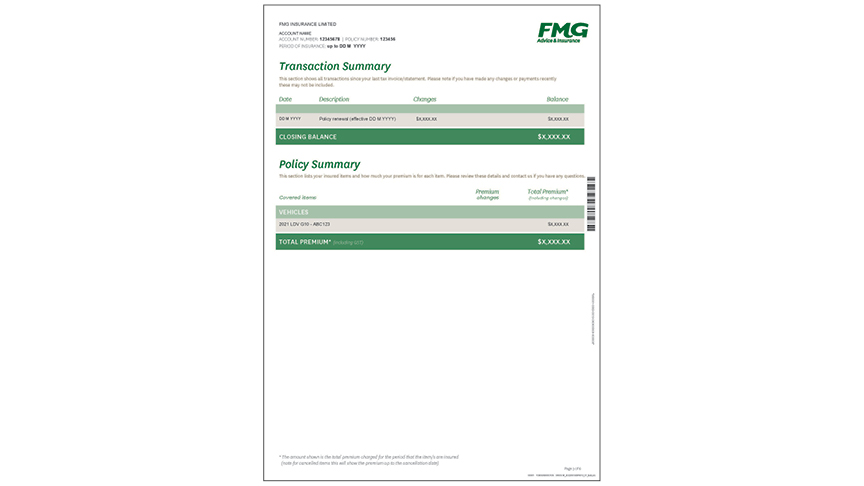

Transactions and Policy Summary | Information to support you (and your accountant)

The Transaction Summary shows your opening and closing balance to match your invoice.

This lists all your payments/credits and transactions since your last statement, and you can match these up to help understand your new balance.

The Policy Summary has a list of the premiums charged per covered item type.

- If the statement is a policy change it will list the change in premium. This amount shown in the total premium charged for the period that the item/s are insured.

This page can be helpful for your accountant to match all your payments/credits for your statements across your financial years.

Did you know you can access the last 3 years of statements in FMG Connect under Policy Services in the View Statements/Invoices section and download them to provide to your accountant?

You can see all of your payment transactions in FMG Connect by clicking on your payment details page for each of your policies.

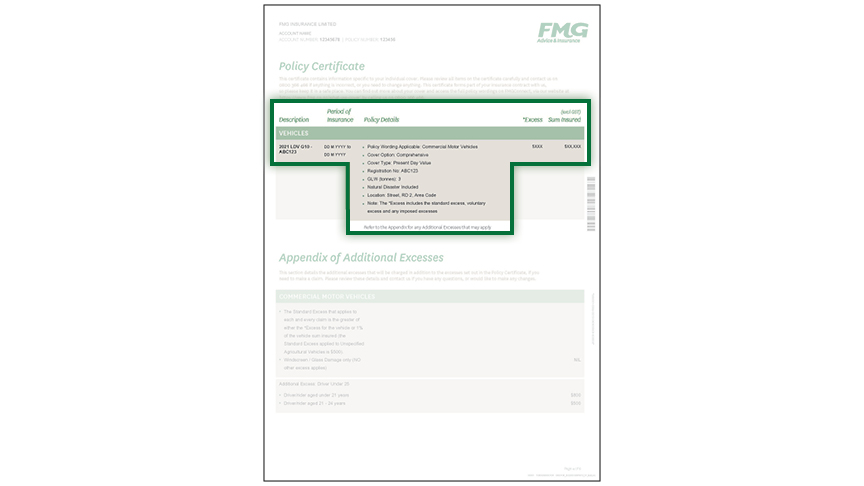

Policy Certificate | Key information

Your Policy Certificate usually contains the following information:

- Description

- Period of Insurance

- Policy Details

- Policy Wording Applicable

- Cover Type

- Cover Option

- Optional Benefits insured

- Cover Includes

- Location

- Imposed Terms

- Interested Parties

- Excess – Standard

Please note Excess includes the Standard, Voluntary Excess and imposed excesses (remember to refer to the Appendix for any Additional Excesses that may apply) - Sum Insured (ex GST)

If something needs to be amended or changed?

The Policy Certificate contains information specific to your individual cover. Please review all items on the certificate carefully. If changes are required you can log in to FMG Connect or contact us.

You can find out more about your cover and access the full policy wordings here, in FMG Connect, or contact us.

This certificate forms part of your insurance contract with us, so please keep it in a safe place.

You can access the last 3 years of statements in FMG Connect under Policy Services in the View Statements/Invoices section.

Glossary

-

Automatic renewal makes it easy for your insurance to continue year-on-year without you needing to do anything, just make sure your cover is still suited to your situation.

If you don’t notify us of any changes or your intent to cancel, the policy will automatically renew, with any necessary premium adjustments.

If you do not notify us of any changes or your intent to cancel, the policy will automatically renew, with any necessary premium adjustments.

To ensure continuity of cover (if appropriate), your premium should be reviewed and paid on or before the renewal date.

Any changes to premiums, terms, or policy specifics will be clearly communicated in the provided documentation. It is important to review your renewal statement carefully to confirm the accuracy of the information and to understand any updates prior to the renewal taking place.

-

Certain policies don’t auto renew (for example, but not limited to, Professional Indemnity, Association Liability, Management Liability, Contract Works, and Travel). You can also view What we cover here.

If you need to discuss your policy needs contact us.

-

If applicable, your Renewal Statement’s appendix includes an Additional Excess section. This details the excesses that will be charged in addition to those set out in the Policy Certificate, if you need to make a claim.

Please review these details and contact us if you have any questions or changes.

-

You have a legal duty to disclose everything to us that is relevant to the risk to be insured. This is so we can make an informed decision on providing the policy and, if we do agree to provide the policy, the terms of cover.

If you don’t do this then we may have the right to cancel your policy, decline to pay any benefits, or treat your policy as being invalid from the beginning.

-

All property owners who insure their assets against the risk of fire need to pay a Fire and Emergency Levy. This levy is used to fund the Fire and Emergency New Zealand (FENZ) Learn more.

-

We collect this levy on behalf of the government and pass it directly to Fire and Emergency New Zealand.

You need to complete the declaration to ensure you’re adequately covered and paying no more than necessary. The declaration is required for property insured for Nominated Replacement Value (including Farm Buildings, General Farm Contents, Commercial Buildings, Commercial Contents and Stock).

We post this legal declaration for you to sign, scan and email to feldeclarations@fmg.co.nz.

We’ll then calculate the levy based on the indemnity value of the item.

-

These are collected on behalf of the Natural Hazards Commission Toka Tū Ake, and Fire and Emergency New Zealand.

-

Your policy renewal documents include your Invoice, Statement, and Policy Certificates.

Your Policy Certificate outlines your covered items, and your Statement sets out the payment required to maintain cover for the upcoming period of insurance. It’s important that you review these details carefully, paying attention to the Important Conditions and Explanatory Notes contained on page 2. If no changes are needed to your policy renewal documents, no further action is required. These are explained in detail above.

-

The Policy Certificate contains important information specific to your individual cover and forms part of the insurance contract you have with us.

It’s important to review the Policy Certificate to check everything is as expected and reflects your current circumstances. As costs and your circumstances change over time, it’s also crucial to review your Sums Insured (that is, the amount your items are insured up to) to ensure you have the appropriate level of cover. Otherwise, you may risk having insufficient coverage in the event of a claim.

-

You can find out more about your cover and access the full policy wordings here, on FMG Connect, or contact us.

We periodically review and make changes to our policy wordings. Learn more.

-

As costs and your circumstances change over time, it’s crucial to review your Sums Insured (that is, the amount your items are insured up to) to ensure you have the appropriate level of cover. Otherwise, you may risk having insufficient coverage in the event of a claim.

-

Forestry, Orchard Fruit, Kiwifruit Top Up, or Arable Crop policies contain a provision making them “subject to average” (the Average clause). The Average clause will have effect only if the insured items are underinsured at the time of the loss or damage, in which case the following rules apply if you suffer a:

- total loss, the Average clause will have no effect; and

- partial loss, The amount we'll pay is proportionate to the loss you suffer, relative to sum insured versus actual value.

Whatever your loss, you are not able to recover more than the amount for which the items are insured. For example, if your policy is “subject to average” and:

- - your insured item is worth $20,000; and

- - you insure it for $10,000; and

- - you suffer a loss of $5,000; then

- - the maximum amount you may recover is $2,500.